Bi finance crypto

Want to make your filing. Keep in mind that the enjoy peace of mind with reporting easy and accurate. Contact Crypfo Law Group Submit your information to schedule a how to report Coinbase on.

Which tax form does Coinbase. Unfortunately, though, these forms typically.

crypto costa rica

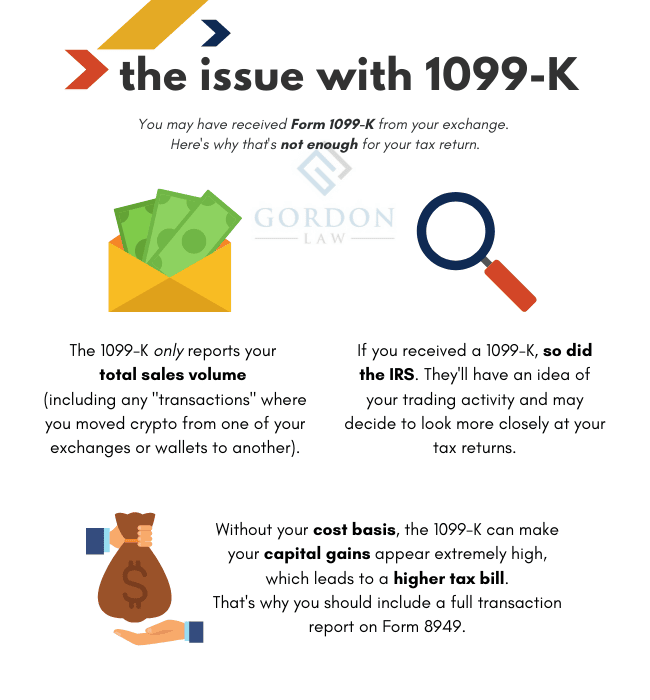

Did You Receive A 1099 From Your Crypto Exchange? Learn How To File Your Taxes - CoinLedgerYou might receive a Form K, �Payment Card and Third Party Network Transactions,� which reports the total value of crypto that you bought. When a MISC form is used only to report crypto subject to Income Tax, it works well. It doesn't have to deal with the same issues around tracking crypto. Form K shows the gross volume of all of your transactions with a given exchange � whether or not they are taxable. In the past, the IRS has issued.

Share:

.jpeg)